- 80 Atlantic Ave 4th Floor, Toronto, ON M6K 1X9 Suite 420

- GET IN TOUCH (289) 813-3378

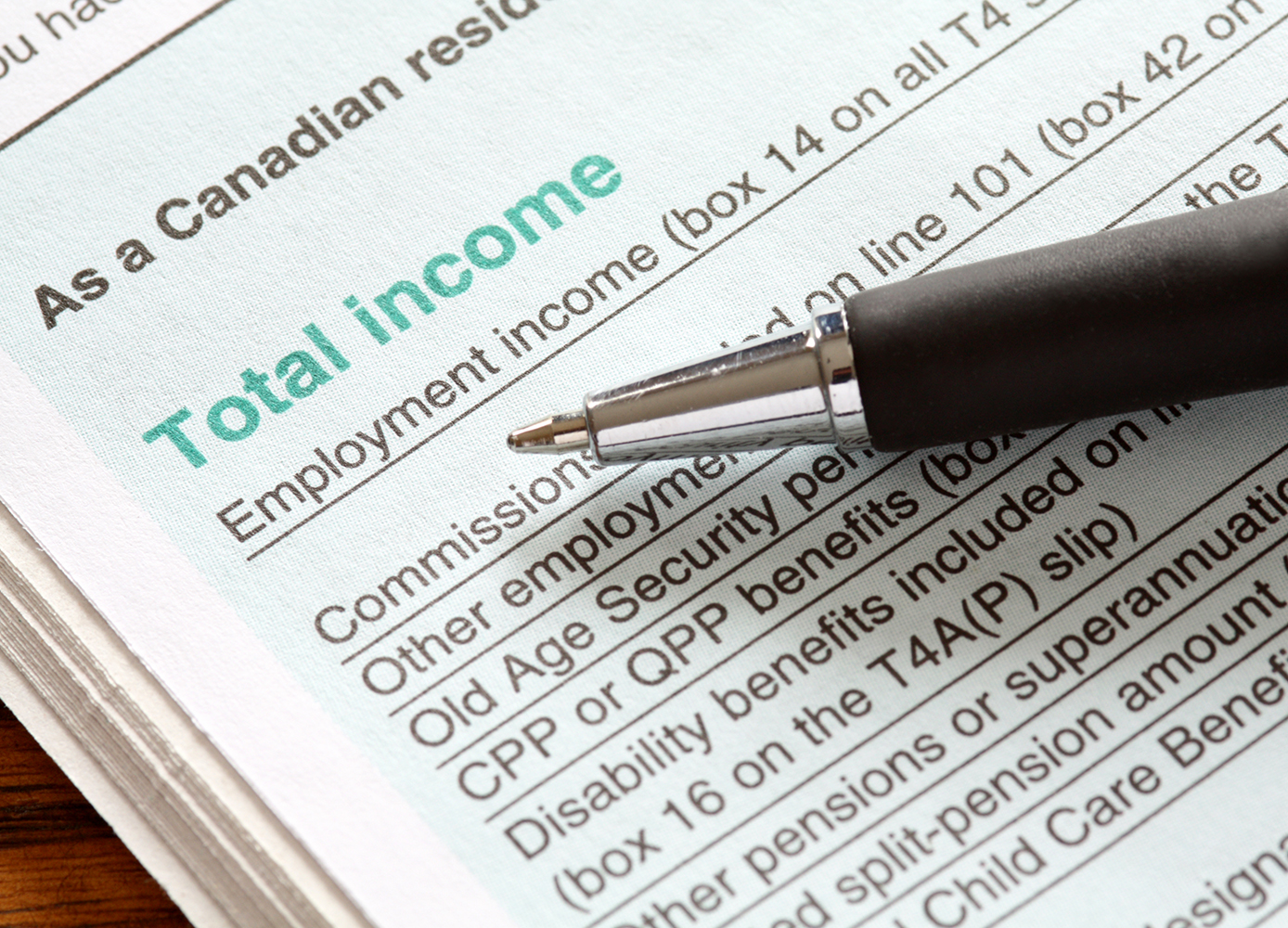

How to File Your 2022 Taxes in Ontario

-

Accounting and Assurance | Bookkeeping | Wealth Management | Real Estate | Tax Planning | CFO & Business Advisory Service | Consulting > Blog > Finance > How to File Your 2022 Taxes in Ontario

Finance

Finance

We are 3 months in 2022, and March has foreshadowed a time of the year that many people dread: tax season. But for those who are new to the country or just turned the legal age – how do you file your 2022 taxes in Ontario?

But taxes don’t have to be a complicated subject. With lots of people rushing to figure out their expenses, it can be a stressful time that entails lots of paperwork, phone calls, and anxiety. For students, this may be their first year filing their taxes on their own, which leads us to our question – What does filing your taxes actually mean? And why does it seem to be something so complicated for most of the population?

In very simple terms, when you are filing taxes you are starting with your taxable income for that year that has been reported to the government. If you didn’t generate any income or not enough income that year, you can still file a return where you may be compensated in various forms from benefits to credits, making it an income tax return.

Reporting your income is the easy part. If you’ve had any source of income over the last year (2021), you’ll have a document called a T4A or T4 mailed to you from your employer. If you haven’t received one in the mail, you can always access your tax information online through Canada.ca by setting up your account. Once you have your T4As and T4s, you can see how much money you earned last year and how much of that income was taxed.

If you are a student currently, one of the best incentives for you to file your 2022 Tax Return is the benefits and credits that you can be eligible for. Filing your taxes in Canada, you can be entitled to moving expenses if you attended College or University on campus or if you traveled to school within a 40km radius of your home address. There’s also credits for tuition and textbook fees that you may have paid throughout the school year. For post-graduate students, OSAP payments and any interest on student loans can be claimed as well.

If you live outside of a major metropolitan area, you can receive the Climate Action Incentive, known as a “carbon tax rebate” which means you get an extra 10% top up. This credit is automatic, you receive just by living within the province and filing your taxes.

When it’s time to file for taxes, there are companies like Progress Group that can help and do the work for you. It’s always a good option to seek professional help, especially if it’s the first time you are doing it yourself and don’t want to get them wrong. Filing your taxes incorrectly can be worrying but it’s also important to know the difference between a simple mistake and tax fraud.

“The basic principle behind the Canadian tax system is that it’s a self-assessing system. Generally speaking, we’ll accept your return as filed. But after the fact, we may subject it to review, so it’s important that, if you make a mistake and you find out about it, let us know as soon as you can. The principle is, if it’s an honest mistake and you catch it, you just let us know and we’ll fix it for you.”

If you are one of the thousands Canadians looking to file their 2021 taxes and want a professional experience, Progress Group has all the resources to get your affairs in order. Feel free to book a session with us or call us at (289) 813-3378.

Categories

- Accounting & Bookkeeping (3)

- Business (1)

- Finance (4)

- Uncategorized (1)

- Wealth Management (1)